Loading

Get 1041 K 1 Codes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1041 K-1 Codes online

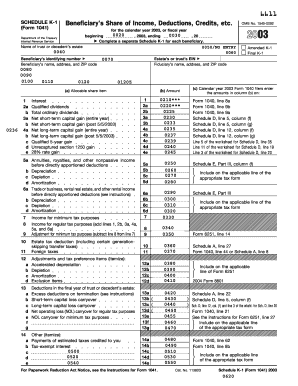

The 1041 K-1 Codes, also known as Schedule K-1, is a crucial form used to report a beneficiary's share of income, deductions, and credits from a trust or estate. This guide provides clear and detailed instructions for completing the form online to ensure accurate filing.

Follow the steps to complete your 1041 K-1 Codes online.

- Click the ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter the name of the trust or decedent’s estate in the designated field.

- Input the beneficiary’s identifying number and their name, address, and ZIP code in the corresponding fields.

- Complete each income section, entering amounts for interest, qualified dividends, and capital gains as applicable. Be sure to differentiate between short-term and long-term gains.

- Fill in deductions, including depreciation and amortization, ensuring to follow the prompts for nonpassive income and rental income.

- Review any additional itemized deductions and adjustments needed for tax purposes, such as the foreign taxes and excess deductions.

- Fill out the estate’s or trust’s employer identification number in the assigned area.

- Finalize your inputs by reviewing all information for accuracy before saving changes, downloading, or printing the completed form.

Complete your 1041 K-1 Codes online today to ensure accurate tax reporting.

Code H. Net investment income tax. This amount is the beneficiary's adjustment for section 1411 net investment income or deductions. Enter this amount on line 7 of Form 8960, as applicable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.