Loading

Get Continuation Sheets For Ct Form 706nt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Continuation Sheets For Ct Form 706nt online

Filling out the Continuation Sheets For Ct Form 706nt online can be a straightforward process when following the right steps. This guide is designed to provide you with clear and supportive instructions to ensure accurate completion of the form.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

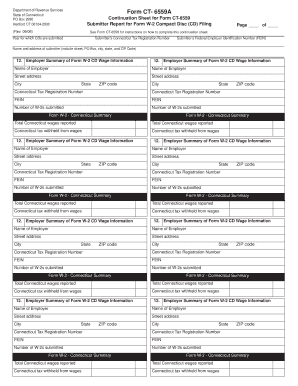

- Begin with the year for which CDs are submitted. Clearly indicate the appropriate tax year in the designated field.

- Enter the submitter’s Connecticut Tax Registration Number as well as the Federal Employer Identification Number (FEIN). These identifiers are crucial for proper tax processing.

- Fill in the name and complete address of the submitter, including street, PO Box, city, state, and ZIP Code. Ensure that this information is current and accurate.

- For the Employer Summary section, complete the employer's name, street address, city, state, and ZIP code.

- Enter the Connecticut Tax Registration Number and the FEIN for the employer. This information verifies the employer’s legitimacy.

- Specify the number of W-2s submitted. This number should correspond to the total W-2 forms being reported.

- In the Form W-2 Connecticut Summary section, report the total Connecticut wages indicated on the W-2 forms and the Connecticut tax withheld from those wages.

- Repeat Steps 5 to 8 for additional employers as necessary, ensuring each employer’s information is clearly listed and properly filled out.

- Once all sections are filled out, review the entire document for accuracy. After confirming all fields are completed correctly, save your changes, and prepare to download, print, or share the form as needed.

Begin your document submission process by completing the forms online today!

Connecticut Estate Tax Exemption For estates of people who died in 2022, the tax won't apply if the estate is less than $9.1 million. As of 2023, the Connecticut estate tax exemption will match the federal exemption of $12.92 million.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.