Loading

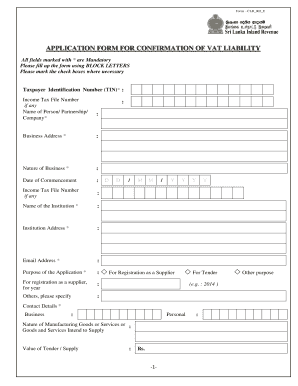

Get Application Form For Confirmation Of Vat Liability

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FORM FOR CONFIRMATION OF VAT LIABILITY online

Filling out the Application Form for Confirmation of VAT Liability is an essential step for businesses seeking to confirm their VAT registration. This guide provides a detailed walkthrough to help users complete the form efficiently and accurately online.

Follow the steps to successfully complete your application form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document platform.

- Enter your Taxpayer Identification Number (TIN) in the designated field. This is a mandatory requirement, so be sure to provide accurate information.

- Fill in the name of the person, partnership, or company applying, ensuring that all fields marked with an asterisk (*) are completed using BLOCK LETTERS.

- Provide your business address in the specified section and ensure it is complete and up-to-date.

- Indicate the nature of your business in the corresponding field. This provides context for your application.

- Enter the date of commencement of your business in the required format (DD/MM/YYYY) to finalize the timeline of your operations.

- If applicable, enter your income tax file number in the next field. Otherwise, you may leave it blank.

- Complete the institution name and institution address fields with accurate information to facilitate correspondence.

- Input your valid email address, which will be essential for receiving updates regarding your application.

- State the purpose of your application by marking the appropriate checkbox and providing any specified details.

- List your contact details for both business and personal use, ensuring you provide reliable means of communication.

- Detail the nature of goods or services you intend to supply. This section is crucial for understanding your business operations.

- Enter the estimated value of the supply or tender you anticipate over the coming year. Ensure that this is a realistic projection.

- If your application is tender-related, indicate whether you have submitted previous tenders and provide necessary particulars if applicable.

- Complete the total turnover for the last twelve months, indicating the economic scale of your operations.

- If registering as a supplier, enter your estimated supply for the next twelve months in the allocated field.

- If applicable, provide details of any authorized representatives or agents, including their registration number and contact details.

- Read and sign the declaration, confirming that all the information provided is true and accurate to the best of your knowledge, including your name, designation, contact number, email, and date.

- Lastly, ensure that you have included all required supporting documents with your application, as listed in the guidelines, before finalizing your submission.

Complete your documents online to ensure a smooth and efficient application process.

The VAT Registration application must be made through one of the following channels: eFiling; or. Make a virtual appointment via our eBooking system by selecting the following options: Appointment channel: Telephonic engagement or Video. Reason category: Other. Reason for appointment: VAT registration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.