Loading

Get California W9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California W9 online

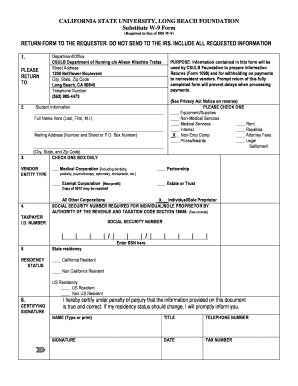

The California W9 form, officially known as the Substitute W-9 Form, is used by individuals and businesses to provide their Taxpayer Identification Number to the California State University, Long Beach Foundation. This guide offers clear, step-by-step instructions for completing the form online to ensure you provide accurate information.

Follow the steps to complete the California W9 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the information for the requester, which includes the department, street address, city, state, and zip code. This section should indicate that the form is to be returned to the CSULB Department of Nursing.

- Provide your full name in the designated line, formatted as Last, First, and Middle Initial. This ensures proper identification.

- Fill in your complete mailing address, including the street address or P.O. Box, city, state, and zip code.

- Check one box indicating your entity type, selecting only one. Options include Equipment/Supplies, Non-Medical Services, Medical Services, Rent, Interest, Royalties, Non-Employee Compensation, Attorney Fees, Prizes/Awards, or Legal Settlement.

- Enter your Taxpayer Identification Number in the field provided. If you are an individual or sole proprietor, your Social Security Number is required. Ensure that it is correct to avoid potential issues.

- Select your residency status by marking the appropriate box. You will need to indicate whether you are a California resident, a non-California resident, a U.S. resident, or a non-U.S. resident.

- In the certifying signature section, type or print your name, title, telephone number, sign the document, and date it. This certifies that the information provided is accurate.

- Review all entered information for accuracy and completeness. Make any necessary corrections.

- Once you are satisfied with the form, you can save your changes, download the completed form, print it, or share it with the requester as needed.

Start completing your California W9 form online today.

Who Needs to Complete Form W-9? You will usually submit a W-9 form when you engage with a company where reporting information to the IRS might be necessary, such as receiving payments for services you provide as an independent contractor, paying interest on your mortgage or even contributing money to your IRA account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.