Loading

Get Vat1615a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat1615a online

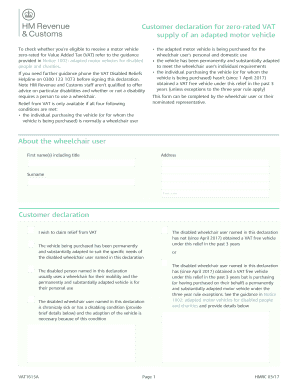

The Vat1615a form is a declaration that enables individuals who qualify to claim relief from Value Added Tax (VAT) for adapted motor vehicles. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring a smooth submission process.

Follow the steps to complete the Vat1615a form online.

- Click ‘Get Form’ button to obtain the Vat1615a form and open it in your preferred online editor.

- Begin by providing the necessary information about the wheelchair user in the designated fields. This includes their first name(s) including title, surname, address, and postcode.

- Review the customer declaration section carefully. Confirm that the user you are declaring for is a wheelchair user, that the vehicle is permanently and substantially adapted for their personal and domestic use, and that they meet the eligibility criteria outlined.

- Indicate if the disabled wheelchair user has obtained a VAT-free vehicle under this relief in the past three years or if they are eligible due to exceptions to this rule. Provide brief details as required in the form.

- If you are the nominated representative, fill in your first name(s) including title and surname in the designated area, confirming your role.

- The wheelchair user or their nominated representative must provide a signature to authenticate the declaration. Also, enter the date of signing in the required format (DD MM YYYY).

- Once all sections are completed and verified for accuracy, save the changes. You can then download or print the completed form.

- Finally, submit the form to the vehicle supplier, who will retain it and send a copy to HMRC as proof for the VAT relief.

Complete and submit your Vat1615a form online today to claim your VAT relief.

If you're disabled you'll generally have to pay VAT on the things you buy, but VAT relief is available on a limited range of goods and services for disabled people. VAT relief that may be available if you're buying goods because of your disability. This guidance explains: how VAT relief works.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.