Loading

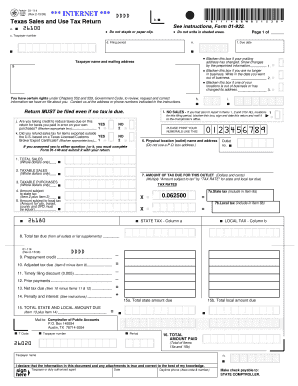

Get 01-114 Texas Sales And Use Tax Return - Texas Comptroller Of ... - Window State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 01-114 Texas Sales And Use Tax Return online

Navigating the process of completing the 01-114 Texas Sales And Use Tax Return can be straightforward with the right guidance. This comprehensive guide will assist you in filling out the form accurately and efficiently.

Follow the steps to complete your Texas Sales And Use Tax Return online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Begin by entering your taxpayer number in section c. Ensure that the number is accurate to avoid any filing complications.

- Fill in the filing period in section d and the due date in section e. These dates are crucial for timely filing.

- If your mailing address has changed, blacken the box in section f and update your information as needed.

- Complete section g to indicate your business status. You can blacken the box if you are no longer in business or if any business locations are out of service.

- In section h, be aware that returns must be filed even if no tax is due. If there are no sales to report, blacken the designated box.

- Section j asks if you are taking credit for taxes you paid in error on your purchases. Please select the appropriate box.

- Section k needs you to indicate if you refunded sales tax for exported items based on an export certificate.

- In section 1, enter your total sales for the period. Round to whole dollars only.

- In section 2, input your taxable sales, also in whole dollars.

- Continue to section 3 to record any taxable purchases made during the filing period.

- In section 4, calculate the amount subject to state tax by adding sections 2 and 3.

- Next, determine the amount subject to local tax in section 5, ensuring the amounts are equal for city and local jurisdictions.

- In section 7, calculate the amount of tax due for each outlet. Multiply the taxable amount by the applicable tax rate.

- Complete sections 8 through 15, detailing total tax due, credits, any discounts, and final amounts payable.

- Finally, review all entries for accuracy, sign the document if required, and proceed to save, download, print, or share the form as instructed.

Start filling out your Texas Sales And Use Tax Return online today to ensure compliance and avoid penalties.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.