Loading

Get Pershing Simple Ira Plan Participation Notice And Summary Description

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pershing SIMPLE IRA Plan Participation Notice and Summary Description online

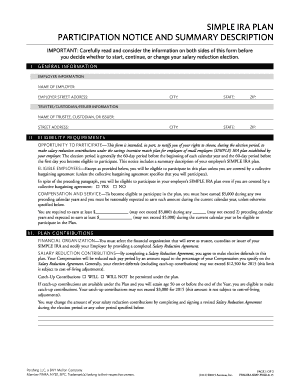

Filling out the Pershing SIMPLE IRA Plan Participation Notice and Summary Description is an important step in participating in your employer's retirement plan. This guide provides a clear, step-by-step approach to complete the form online, ensuring you have the necessary information to make informed decisions regarding your retirement savings.

Follow the steps to complete the form accurately and effectively.

- Click ‘Get Form’ button to access the document and open it in your online editor.

- Begin by entering the name and street address of your employer in the designated fields under 'Employer Information'. Make sure to include the city, state, and ZIP code.

- In the 'Trustee/Custodian/Issuer Information' section, fill in the name and street address of the trustee, custodian, or issuer managing your SIMPLE IRA.

- Review the eligibility requirements carefully. Indicate whether you are covered by a collective bargaining agreement that allows participation in the plan.

- Provide your compensation details by filling in the required amounts in the compensation and service section to ensure your eligibility status.

- Select your financial organization for your SIMPLE IRA, and complete the Salary Reduction Agreement as specified. Here, note your desired salary reduction contributions.

- Decide whether to permit catch-up contributions if you are eligible, and fill out the relevant fields accordingly.

- Review the employer contribution options and fill in any required percentages or dollar amounts relevant to your participation in the plan.

- Lastly, save your changes. You can choose to download, print, or share the completed form as needed.

Complete your forms online today to secure your participation in the Pershing SIMPLE IRA plan.

SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees Individual Retirement Accounts, is employer-sponsored. This means it is offered to employees through a business. These types of retirement plans are made specifically for small businesses with 100 or fewer employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.