Loading

Get Tp584

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tp584 online

Filling out the Tp584 online can simplify the process of reporting real estate transactions. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the Tp584 form.

- Press the ‘Get Form’ button to obtain the Tp584 document and open it in the digital editor.

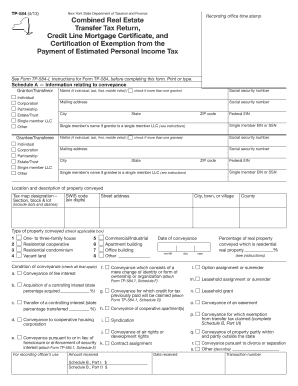

- Begin by filling out Schedule A, which requires the grantor's and grantee's information. Ensure to enter names, social security numbers, mailing addresses, and any relevant business identification numbers if applicable. Indicate the type of entity (individual, corporation, etc.).

- Provide the location and description of the property being conveyed. Enter the tax map designation, SWIS code, street address, and type of property conveyed by checking the appropriate boxes.

- Complete Schedule B, Part I by calculating the real estate transfer tax. Enter the amount of consideration for the conveyance and deduct any applicable deductions to determine the taxable consideration. Follow the calculations as detailed before proceeding.

- If applicable, complete Schedule B, Part II for additional tax due on residential properties valued at one million dollars or more by entering the corresponding consideration. Follow the instructions to calculate the additional tax.

- Address any exemptions related to the conveyance in Schedule B, Part III. Check the relevant boxes and include any required explanations as needed.

- If there is a credit line mortgage involved, fill out Schedule C appropriately, certifying the status of the mortgage and providing any necessary details.

- Finally, ensure all required signatures are obtained from both grantors and grantees. Each person involved must sign and date the form to certify the provided information.

- After completing the Tp584, you can save the changes, download, print, or share the form as needed for your records or submission.

Complete your Tp584 form online today to streamline your real estate transaction process.

Related links form

NYC & New York State Transfer Taxes: Transfer taxes are paid by sellers (unless it's a new development and you are the sponsor). The New York City Real Property Transfer Tax is 1% of the price if the value is $500,000 or less, or 1.425% if it is more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.