Loading

Get Ontario Trillium Benefit Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ontario Trillium Benefit Application Form online

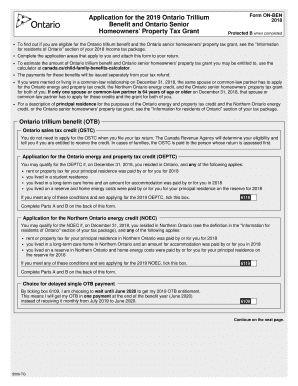

The Ontario Trillium Benefit Application Form allows users to apply for various benefits and credits related to property tax and energy costs. This guide provides clear, step-by-step instructions on how to successfully complete the form online.

Follow the steps to complete your application effortlessly.

- Press the ‘Get Form’ button to access the Ontario Trillium Benefit Application Form, allowing you to begin filling it out online.

- Carefully read through the introduction section of the form to ensure you understand the eligibility criteria for the Ontario Trillium Benefit and other credits. This will help you determine which areas you need to fill out.

- In the application areas, mark the boxes corresponding to the benefits you are applying for, including the Ontario energy and property tax credit, Northern Ontario energy credit, and Ontario senior homeowners’ property tax grant, as applicable to your situation.

- For each benefit, ensure you complete Parts A and B as specified on the form. This includes entering the total amounts for rent, property tax, or home energy costs incurred in 2018.

- If applicable, provide details regarding your spouse or common-law partner's address and information about any involuntary separation due to medical reasons, as indicated in Part C.

- Review all the information you have entered to confirm accuracy and completeness before finalizing the form.

- Once you have filled out the form, save your changes. You can then download, print, or share your completed application form as needed.

Begin completing your Ontario Trillium Benefit Application Form online today to ensure you receive the benefits you are entitled to.

The Ontario Trillium Benefit is a refundable tax credit for low to moderate income residents of Ontario. It is designed to help pay for energy costs, sales, and property tax. The credit combines the below three tax credits. You only need to qualify for one of these credits to be eligible for the benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.