Get In-kind Donation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In-Kind Donation online

Filling out the In-Kind Donation form accurately is crucial for proper processing and acknowledgment of your donation. This guide provides clear, step-by-step instructions to ensure that you complete the form efficiently and in accordance with the requirements.

Follow the steps to accurately complete the In-Kind Donation form.

- Click the ‘Get Form’ button to access the In-Kind Donation form and open it in your document editing tool.

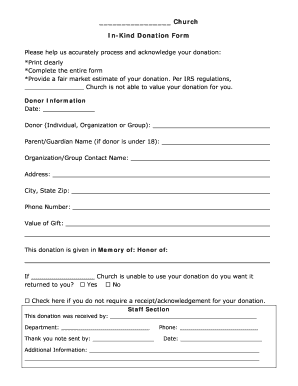

- Fill in the 'Donor Information' section. Provide the date of the donation, your name as an individual or organization, and if applicable, the name of a parent or guardian if the donor is under 18. Include the organization or group contact name, complete address, and your phone number.

- Enter the estimated value of your gift in the designated field. Ensure this estimate reflects a fair market value as required by IRS regulations, as accuracy is important for compliance.

- Indicate if this donation is given in memory of someone or in honor of an individual by filling in the respective fields.

- Answer the question regarding whether you would like the donation returned if the church cannot use it by selecting 'Yes' or 'No'.

- If you do not require a receipt or acknowledgment for your donation, check the provided box to signify this preference.

- In the 'Staff Section,' make sure that the receiving staff member records their name, department, and the date on which the donation was received. Additionally, the staff should input the name of the individual who sends the thank you note.

- Use the 'Additional Information' section to provide any further details or context about your donation that you think may be relevant.

- Once you have completed all sections of the form, review your entries for accuracy. You then have the options to save your changes, download the form, print it out, or share it as needed.

Complete your In-Kind Donation form online today and make a meaningful contribution!

Filling out a donation receipt requires careful attention to detail to ensure accuracy. Start with the donor's name and contact information, followed by the organization’s name and address. Specify the date of the contribution, list the items donated, and provide a total value estimate. Closing with a statement about the lack of goods or services received in return clarifies the nature of the donation, providing both parties peace of mind.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.