Loading

Get Irs 2016 W2 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

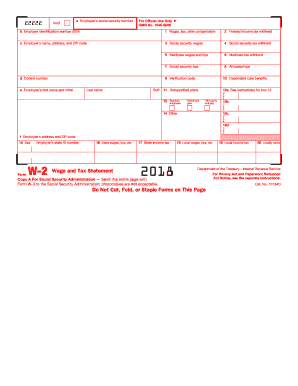

How to fill out the IRS 2016 W-2 form online

Filling out the IRS 2016 W-2 form correctly is essential for both employers and employees for accurate tax reporting. This guide provides step-by-step instructions for completing the form online in a clear and supportive manner.

Follow the steps to complete the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the IRS 2016 W-2 form and open it in your browser.

- Begin by entering the employee's social security number in Box a. Ensure that the number is accurate to avoid any issues with tax reporting.

- Input the employer identification number (EIN) in Box b. This number is crucial for identifying the employer in tax documentation.

- In Box 1, report the total wages, tips, and other compensation received by the employee for the year.

- Fill in Box 2 with the total federal income tax withheld from the employee's paychecks during the year.

- Provide the employer's name, address, and ZIP code in Box c, ensuring that it is correctly formatted.

- Input the social security wages in Box 3 and the corresponding social security tax withheld in Box 4.

- Report the Medicare wages and tips in Box 5 and any Medicare tax withheld in Box 6.

- Fill in any allocated tips in Box 8. If applicable, note social security tips in Box 7.

- Complete any additional information required in Boxes 10 through 20 based on the employee's specific tax situations.

- Review the completed W-2 form for accuracy before finalizing.

- Once finished, you can save the changes, download the form for printing, or share it electronically as needed.

Start filling out the IRS 2016 W-2 form online today to ensure accurate tax reporting.

If the tax year is for a prior year, you can obtain the necessary blank form. Visit the IRS's website to retrieve and print past years' W-2 form. ... Select “Forms and Publications” from the left side of the page. ... Type “W-2” in the “Find” box, then scroll through the list of documents for the prior year W-2 that you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.