Loading

Get 2013 Instructions For Form 3805v -- Net Operating Loss (nol ... - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 instructions for Form 3805V -- Net Operating Loss (NOL) online

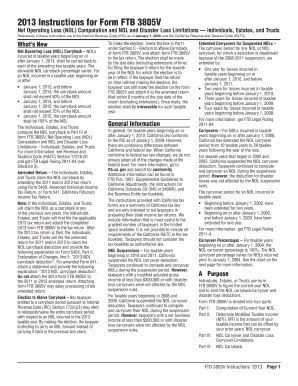

This guide provides comprehensive, step-by-step instructions to assist users in filling out the 2013 instructions for Form 3805V, which is essential for calculating net operating losses in California. By following these clear directions, users can confidently complete the form online.

Follow the steps to accurately complete the Form 3805V online.

- Press the 'Get Form' button to access the form and open it in your online editor.

- Begin with Part I to compute your current year NOL. Enter your total income and deductions as outlined. Be sure to include any applicable capital losses and carryover deductions.

- Continue to Part II to determine your modified taxable income (MTI). This involves modifying your taxable income to ascertain how much of your net operating loss can be carried over to the next year.

- In Part III, document any NOLs and disaster loss deductions actually utilized in 2013 and how much will be carried over. This section also helps you track expiration and limitations of any carryovers.

- Complete Part IV to apply for NOL carryback. Follow the instructions provided for determining how much of your NOL can be carried back to previous taxable years.

- Review all sections for accuracy. Once completed, you can save your changes, download the form, print it for your records, or share it as needed.

For more guidance on completing your tax documents, explore resources online.

NOL Steps Complete your tax return for the year. ... Determine whether you have an NOL and its amount. ... If applicable, decide whether to carry the NOL back to a past year, or to waive the carryback period and instead carry the NOL forward to a future year. ... Deduct the NOL in the carryback or carryforward year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.