Loading

Get Form 169

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 169 online

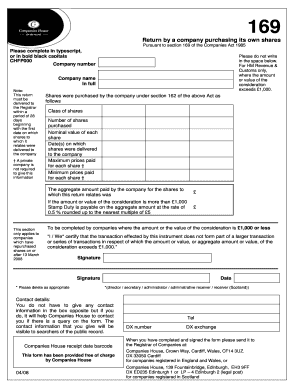

Filling out Form 169 correctly is essential for companies that are purchasing their own shares. This guide provides clear steps to help you navigate the online process, ensuring you complete the form accurately and efficiently.

Follow the steps to complete Form 169 online

- Press the ‘Get Form’ button to retrieve the form and open it in your online editor.

- Enter the company number in the designated field, using bold black capital letters for clarity.

- In the 'Company name' section, write the full name of your company. Ensure correctness as this will be used for official records.

- If applicable, provide the details of the shares repurchased, including the class of shares, the number of shares purchased, and the nominal value of each share.

- Indicate the dates on which the shares were delivered to the company, and the maximum and minimum prices paid for each share.

- Calculate and enter the aggregate amount paid by the company for the shares, ensuring it is accurate to avoid complications with the HM Revenue & Customs.

- If the consideration amount exceeds £1,000, ensure to complete the required stamp duty calculation and include the stamped document when submitting.

- Where required, certify the transaction's details in the provided section, ensuring to select the appropriate signatory roles by deleting options that do not apply.

- After completing and signing the form, save any changes made, and download a copy for your records.

- Print the form if required, and prepare to send it to the Registrar of Companies at the appropriate address based on your company's registration in England, Wales, or Scotland.

Complete your document online with confidence and ensure compliance with all filing requirements.

Entities using the EZ computation method forego any credits for that report year, including the temporary credit for business loss carryforwards. The franchise tax rate for entities choosing to file using the EZ computation method is 0.331% (0.00331).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.