Loading

Get Fr 3517-s-sd 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FR 3517-S-SD online

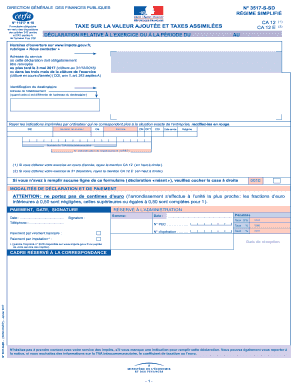

Filling out the FR 3517-S-SD form online can seem daunting, but with clear guidance, you can navigate it effectively. This guide will walk you through each component of the form to ensure you provide accurate and complete information.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the FR 3517-S-SD form and open it in the designated editor.

- Begin by entering the 'Identification du destinataire' section. Fill in the address of the recipient, ensuring accuracy, especially if it differs from the establishment’s address.

- Review any pre-printed information on the form. Cross out any incorrect printed entries using red ink and enter the accurate details where necessary.

- Fill in your firm's SIRET number, number of the dossier, and other required identification numbers. Be sure to check these against your records for correctness.

- Complete the table for 'Modalités de déclaration et de paiement.' Make sure not to enter cents; round amounts to the nearest whole number as instructed.

- In the 'TVA brute' section, record all applicable operations. Carefully classify each transaction as either taxable or non-taxable and ensure to indicate the proper base amounts for taxes due.

- Proceed to the 'TVA déductible' section. Input all relevant deductions for goods and services according to your records, verifying that you have supporting invoices as needed.

- Calculate the net VAT due in the 'TVA nette' section. Subtract the total deductible VAT from the total due VAT, ensuring clarity in your calculations.

- For the refund request in section VI, complete the necessary information clearly to avoid delays. Specify the amount to be refunded, and don't forget to sign and date the form appropriately.

- Once you have filled out all sections, review the form for accuracy. Save any changes, download, print, or share the completed form as required for submission.

Complete your FR 3517-S-SD form online to ensure timely compliance with your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a 1040EZ tax return, first gather all necessary documents, such as W-2 forms and any other income statements. Follow the form's layout to enter your personal details, reported income, and any applicable adjustments. Be sure to refer to the FR 3517-S-SD for guidance on maximizing your deductions. For additional help, uslegalforms offers tools to ensure you complete your return accurately and efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.