Loading

Get Dma 5052

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DMA 5052 online

This guide provides comprehensive instructions on how to fill out the DMA 5052 form online. Designed to assist individuals with varying levels of experience, this guide clarifies each step for a smooth completion process.

Follow the steps to successfully complete your DMA 5052 form online.

- Press the ‘Get Form’ button to access the DMA 5052 form, which will open it in your preferred editor for online completion.

- Begin by entering your personal information in the designated fields, including your full name, address, and contact details.

- Provide your case number and the name of your caseworker as prompted. Ensure that these details are accurate to avoid processing delays.

- Indicate whether you are the applicant, a recipient, or a representative by selecting the appropriate option.

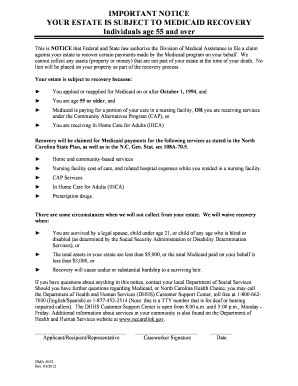

- Review the instructions regarding Medicaid recovery and heartedly acknowledge the conditions that apply by checking the corresponding box.

- If applicable, include information about any surviving heirs and any relevant hardship circumstances that may apply.

- After ensuring all information is complete and accurate, choose to save your changes, download a copy of the completed form, print it, or share it as necessary.

Complete your DMA 5052 form online today to ensure accurate processing.

The NCFAST-20020 is a prepopulated renewal form for the beneficiary to validate that current information remains the same or indicate changes and provide self-attestation of eligibility requirements, including income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.