Loading

Get Stop 6525 Sp Cis

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stop 6525 Sp Cis online

Filling out the Stop 6525 Sp Cis form may seem daunting, but this guide will help simplify the process. We will provide you with detailed instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Stop 6525 Sp Cis form online.

- Click 'Get Form' button to obtain the form and open it in your chosen editor.

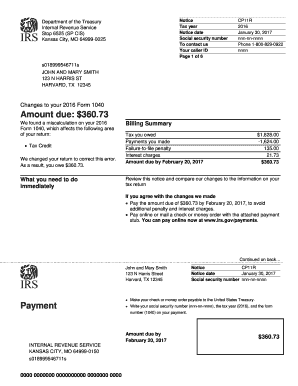

- Review the notice date and tax year located at the top of the form. Ensure that these details are correct for your records.

- Enter your social security number in the designated field. This is crucial for identifying your tax records.

- Fill in the billing summary section with any relevant amounts, including tax owed, payments made, penalties, and interest charges. This section provides a clear summary of your financial obligations.

- In the 'What you need to do immediately' section, follow the appropriate actions based on whether you agree or disagree with the changes made to your Form 1040.

- If you agree with the changes, follow the payment instructions outlined in the payment section. You can select to pay online or by mail, ensuring to provide all the necessary details included.

- If you disagree with the changes, draft a written response within 60 days of the notice date and include any justification for your disagreement. Make sure to send this to the provided contact address.

- Review all the information filled in the form for accuracy before finalizing your submission. This will help prevent any potential issues with your tax records.

- Once you have completed the form, save changes, download a copy for your records, print it, or share it with the necessary parties as needed.

Complete your documents online today to ensure smooth processing and timely handling of your tax matters.

An audit letter will arrive in an envelope via certified mail through the U.S. Post Office and will clearly identify your name, taxpayer ID, form number, employee ID number, and contact information. The language of an IRS audit letter tends to be very straightforward and clearly states the intentions of the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.