Loading

Get Form Pay05 - Office Of The Accountant General, Home

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form PAY05 - Office Of The Accountant General, Home online

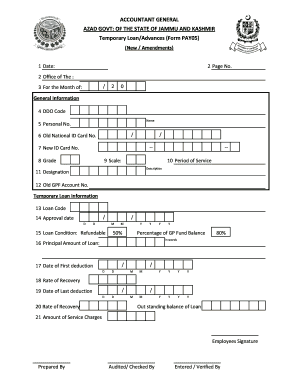

Filling out the Form PAY05 - Office Of The Accountant General, Home is an important process for applying for temporary loans or advances. This guide provides a clear, step-by-step approach to help users complete the form accurately and effectively.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date in the designated field at the top of the form. This should be the current date of completion.

- Fill in the page number where applicable, generally for document tracking purposes.

- Specify the office of the Accountant General you are applying to by filling in the relevant section.

- Indicate the month for which you are applying for the loan by filling in the relevant section.

- Provide your DDO (Drawing and Disbursing Officer) code in the designated field, which helps identify your account.

- Enter your full name as it appears on your official documents.

- Input your personal number, which serves as your unique identification within the office system.

- Fill in your old national ID card number and, if applicable, your new national ID card number.

- Enter your grade and scale of service in the provided sections.

- Describe your period of service in detail, as required.

- Specify your designation or the job title you hold.

- Provide your old GPF (General Provident Fund) account number to link your loan application.

- Enter the loan code associated with your application.

- Fill in the approval date by entering the day, month, and year when the loan was approved.

- State the loan condition. Mark whether it is refundable, providing the percentage of the GP fund balance related to the loan.

- Specify the principal amount of the loan requested in the appropriate field.

- Indicate the date of the first deduction from your salary for loan repayment.

- Provide the rate of recovery, which refers to the percentage deducted from your salary for the loan repayments.

- Input the date of the last deduction, ensuring that it reflects the final payment you have made.

- Document the outstanding balance of the loan and the amount of service charges that might apply.

- Lastly, ensure to sign the application as the employee and include any pre-requisite verification information if needed.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as required.

Complete your Form PAY05 online today for a streamlined application process.

GPF Information The subscribers may access their AISPF/GPF/TPF data by logging into their account using Number & suffix – Date of birth (password) and also download their account statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.