Loading

Get Pera Application For Refund Direct Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pera Application For Refund Direct Rollover Form online

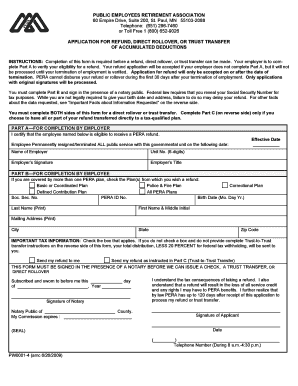

The Pera Application For Refund Direct Rollover Form is essential for individuals seeking a refund, direct rollover, or trust transfer of their accumulated deductions. This guide offers comprehensive instructions to help users successfully complete the form online.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part A, your employer needs to verify eligibility for a refund. Ensure they fill out their details, including the date of termination and their signature.

- Move to Part B, where you, the employee, will provide personal information. Fill out your Social Security number, PERA ID number, birth date, last name, first name, and mailing address comprehensively.

- In Part B, check the applicable boxes regarding the PERA plan for which you want a refund. This selection helps specify which plan details you need processed.

- Indicate your tax preferences in Part B. Check the appropriate box to instruct whether you wish to receive the refund directly or through the Trust-to-Trust transfer.

- Sign Part B in the presence of a notary public. Ensure the notary completes their part by adding their signature and relevant details.

- If opting for a direct rollover or trust transfer, complete Part C by indicating how much of your refund should be transferred and to which qualified plan or IRA.

- Provide the contact details of the qualified plan or IRA, including the name, address, and account number for the intended transfer in Part C.

- Review the entire form for completeness and accuracy before saving your progress. Once satisfied, you can download, print, or share the completed document.

Complete your Pera Application For Refund Direct Rollover Form online today to ensure a smooth process for your refund or transfer.

There are two ways to do a rollover. You can do either a direct rollover or a 60-day rollover. If you do a direct rollover, PERA will make the check payable to your IRA or an employer plan. You should contact the IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.