Loading

Get Wg15 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wg15 Form online

Filling out the Wg15 Form online can seem challenging, but with the right guidance, it can be a straightforward process. This guide aims to provide you with clear, step-by-step instructions to ensure accurate completion of the form.

Follow the steps to successfully fill out the Wg15 Form online.

- Click ‘Get Form’ button to obtain the Wg15 Form and open it in the editor. This will allow you to start entering the necessary information.

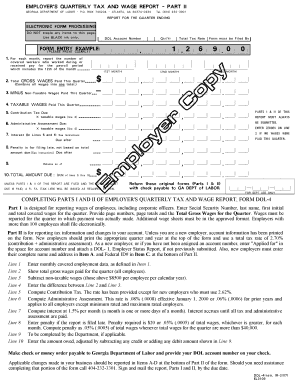

- Enter your DOL Account Number at the top of the form. Ensure that this number is accurate to avoid any processing issues.

- For each month of the quarter, report the number of covered workers who worked during or received pay for the payroll period that includes the 12th of the month. This information is critical for accurate calculations.

- Enter the total gross wages paid for the quarter in the designated field. This total should include all employees.

- Subtract any non-taxable wages from the total gross wages and enter this amount. Non-taxable wages refer to wages above $8,500 per employee per calendar year.

- Calculate the taxable wages by entering the difference between the total gross wages and non-taxable wages.

- Compute the contribution tax due using the taxable wages. Ensure you apply the correct tax rate as instructed.

- Calculate the administrative assessment. This assessment is based on the taxable wages entered prior.

- If applicable, calculate interest on the amounts due depending on the specific instructions related to your tax obligations.

- If the form is being submitted late, compute any penalties that may apply according to the previously mentioned rates.

- Finally, enter the total amount due at the bottom of the form by summing lines 5 through 9, ensuring all values are accurate.

- Review all entries for accuracy before saving your changes. After your review, you can download, print, or share the completed form as needed.

Start completing your Wg15 Form online now to ensure accurate reporting and timely submission.

Pay stubs, earnings statement or W- 2 form identifying employee and showing amount earned period of time covered by employment. Signed and dated form or letter from employer specifying amount to be earned per pay period and length of pay period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.