Loading

Get Form Conv Llc Gs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Conv Llc Gs online

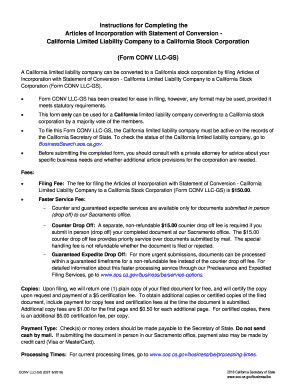

Filling out the Form Conv Llc Gs is a crucial step for a California limited liability company converting to a California stock corporation. This guide provides a clear, step-by-step approach to ensure a smooth and accurate submission.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the proposed name of the converted corporation as it will appear on the records. Ensure the name meets legal requirements for corporation names.

- Provide the complete initial street address of the converted corporation, including all necessary details for city, state, and zip code.

- If there is a different mailing address, provide it as instructed. This can include a P.O. Box or a 'in care of' address.

- Designate an Agent for Service of Process. Choose either an individual residing in California or a registered corporate agent. Complete the relevant items based on your choice.

- If designating an individual, provide their complete name and physical address. If a corporate agent is selected, provide the exact name as registered.

- Indicate the number of shares the corporation is authorized to issue, ensuring it is at least one share and denotes a single class of shares.

- Complete the purpose statement as it details the lawful activities the corporation may engage in.

- Enter the full name of the existing California limited liability company that is converting and provide the 12-digit Entity (File) Number.

- Include the required conversion statement in the form as directed.

- Gather signatures from all members or managers as per the management structure of the LLC. Attach additional signatures if necessary.

- Review the form for accuracy and completeness and then finalize your submission. You can save changes, download, print, or share the form.

Complete and submit your Form Conv Llc Gs online to ensure a successful conversion process.

File a Certificate of Conversion (Form CONV-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person; The filing fee is $150 if a California Corp is involved; and $30 for all others.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.