Loading

Get Monthly Tax Tables 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Monthly Tax Tables 2021 online

This guide provides comprehensive instructions on completing the Monthly Tax Tables 2021 online. By following these steps, users will be able to accurately fill out the form and ensure compliance with tax regulations.

Follow the steps to accurately complete the Monthly Tax Tables 2021.

- Press the ‘Get Form’ button to access the Monthly Tax Tables 2021. This will allow you to download the necessary document for completion.

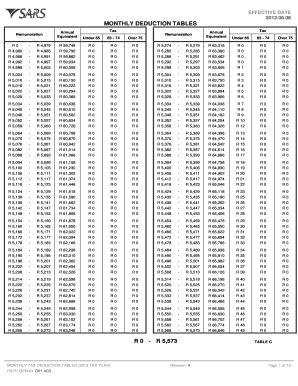

- Review the form sections carefully. The document contains tables with remuneration ranges and associated tax deductions based on age categories (under 65, 65-74, and over 75). Ensure you understand each category as this will guide you in selecting the correct information.

- Identify your remuneration amount within the provided tables. Based on your income, locate the appropriate row which outlines tax deductions applicable to your remuneration.

- Refer to the age category. Check your age group against the corresponding tax deductions to ensure accuracy in the calculations.

- Make note of the calculated tax deductions. This information is crucial for completing your tax filings accurately each month.

- After completing all relevant sections, review the information to confirm it is complete and accurate to avoid discrepancies during submission.

- Save your completed form. You can then download, print, or share the form as needed, ensuring you maintain a copy for your records.

Start filling out your Monthly Tax Tables 2021 online today for smoother tax management!

2021 tax brackets Tax rateSingleHead of household10%$0 to $9,950$0 to $14,20012%$9,951 to $40,525$14,201 to $54,20022%$40,526 to $86,375$54,201 to $86,35024%$86,376 to $164,925$86,351 to $164,9003 more rows • 4 days ago

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.