Loading

Get Statement Of Denial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Denial online

Filling out the Statement Of Denial online can seem daunting. However, this guide provides clear, step-by-step instructions to help you navigate the process efficiently and effectively.

Follow the steps to complete the Statement Of Denial online.

- Click the ‘Get Form’ button to access the Statement Of Denial form. This will allow you to open and begin editing the document.

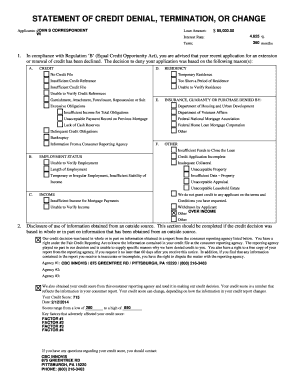

- Start by entering the applicant's information, such as the name and location of the person applying for credit.

- Fill in the loan amount requested by the applicant and ensure that it is clearly stated.

- Input the interest rate and term duration. The interest rate should be a percent value while the term should reflect the loan duration in months.

- Review the reasons for denial listed in the form. This section includes various options related to credit, residency, income, and employment status. Select the reasons applicable to the denial of credit.

- Complete the section that discloses the sources of information obtained from outside entities that influenced the credit decision. Be sure to specify the consumer reporting agencies involved.

- Indicate the applicant's credit score and any key factors adversely affecting it, if applicable. This will help the applicant understand their credit situation better.

- Review any additional remarks or information that could assist in evaluating the applicant’s creditworthiness. This is an opportunity for the applicant to provide more context.

- Complete the notification section by filling in details about the creditor’s institution and the dates relevant to the credit report and official communications.

- Once all sections are filled out completely, save the changes you made. You can also download, print, or share the filled form as necessary.

Start filling out your documents online today!

The term credit denial refers to the rejection of a credit application by a prospective lender. Financial companies issue denials to applicants who aren't creditworthy. The majority of denials are the result of previous blemishes on a borrower's credit history.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.