Get Building On Own Land Maximum Mortgage Worksheet 5 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Building on Own Land Maximum Mortgage Worksheet 5 online

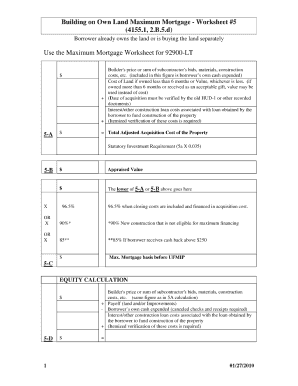

Filling out the Building on Own Land Maximum Mortgage Worksheet 5 is an essential process for individuals seeking to secure a mortgage for building on their own land. This guide will provide you with step-by-step instructions to ensure that your form is completed accurately and efficiently.

Follow the steps to successfully complete your mortgage worksheet online.

- Locate and utilize the 'Get Form' button to access the worksheet. This will allow you to retrieve the form and open it in an online editor.

- Begin by entering your personal information in the designated fields. This typically includes your full name, contact details, and any other identifying information requested.

- Next, indicate the property details. This section often requires you to provide the address of the land you intend to build on, the type of structure you plan to construct, and any relevant zoning details.

- After providing property details, focus on the financial information. Enter your income and any assets you possess, as well as liabilities or existing debts that may impact your mortgage application.

- Make sure to review each section for accuracy. Check that all information entered aligns with documentation you possess, such as tax returns or bank statements.

- Once you have confirmed that all fields are filled out correctly, you can save your changes. Depending on the editor's features, you may also have options to download, print, or share the completed form.

Take the next step toward your mortgage application by filling out the Building on Own Land Maximum Mortgage Worksheet 5 online today.

Building a house on your land is feasible, but there are certain regulations and permits you need to consider. Before you start construction, it's essential to verify zoning laws and obtain the necessary licenses. A Building on Own Land Maximum Mortgage Worksheet 5 can assist you in planning your budget and assessing whether you need financing for your project.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.