Loading

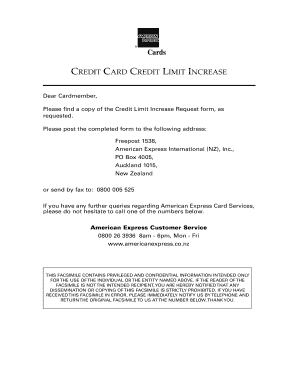

Get Credit Card Credit Limit Increase

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CREDIT CARD CREDIT LIMIT INCREASE online

This guide provides a detailed overview of how to complete the Credit Card Credit Limit Increase request form online. It offers step-by-step instructions tailored to support users through the process effectively and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the application form and open it in the online editor.

- Fill in your personal details, including your card membership number and full legal name as stated on your identification. Be sure to indicate if your expenses are shared with a partner.

- Complete the assets section by providing market values for your home, any other property, bank account funds, and other assets you may have. Ensure that you specify any additional assets or investments.

- In the liabilities section, list your home mortgage, outstanding payments, and any other loans. Attach proof of income, such as a recent payslip or tax return, to support your application.

- Provide your employment details, including your current occupation and employer’s information. If you are self-employed, include the nature of your business.

- In the signature section, sign the application to agree to the terms and conditions. Ensure you include the date of signature.

- Complete the declaration section, confirming that the information provided is accurate and authorizing American Express to verify it. Review this section carefully before submitting.

- After filling out all required fields and reviewing your application, save your changes. You can then download, print, or share the completed form as needed.

Take the next step towards increasing your credit limit by completing your application online.

Increasing your credit limit lowers your credit utilization ratio. If your spending habits stay the same, you could boost your credit score if you continue to make your monthly payments on time. But if you drastically increase your spending with your increased credit limit, you could hurt your credit score.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.