Loading

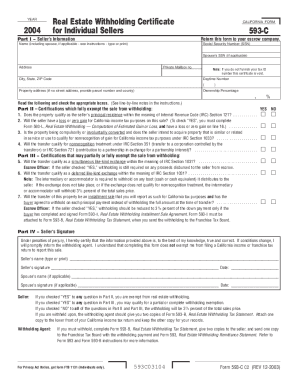

Get 2004 California Forms 593-c, 593-l, And Instructions Form 593-c, Real Estate Withholding

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 California Forms 593-C, 593-L, And Instructions Form 593-C, Real Estate Withholding online

Filling out the 2004 California Forms 593-C and 593-L online can seem daunting, but understanding the steps involved can simplify the process. This guide provides clear instructions for each section, ensuring that you can complete the forms accurately and efficiently.

Follow the steps to fill out the forms correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the seller’s information on Form 593-C. This includes the name, address, and taxpayer identification number. If you are an individual seller, enter your Social Security Number. For couples filing jointly, include both names and SSNs.

- Provide your ownership percentage, rounding to two decimal places (e.g., 66.67%). If your name is on the title but you do not have financial ownership, enter 0.00.

- Proceed to Part II of Form 593-C to determine if you qualify for a full exemption from withholding. Answer the relevant yes/no questions regarding your principal residence and whether you anticipate a loss or zero gain for California income tax purposes.

- If you did not qualify for an exemption in Part II, complete Part III to check if you might qualify for a partial exemption, such as through a simultaneous exchange or installment sale.

- In Part IV, ensure you sign the form and provide the date. This form must be returned to your escrow officer by the close of escrow for it to be valid.

- Next, complete Form 593-L only if you believe you may have a loss for withholding purposes. Carefully go through each line to calculate your estimated gain or loss, entering data as required.

- Once all information is accurately input, review the forms for any errors or omissions. After confirming the information, you can save the completed forms.

- Finally, download, print, or share the completed documents as necessary to keep for your records and ensure compliance with tax regulations.

Start filling out your documents online today to ensure timely processing and compliance!

Information for Sellers. California law requires withholding when a person (an individual, business entity, trust, or estate) sells California real property unless the seller qualifies for an exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.