Loading

Get Oklahoma Form 513nr Instructions 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Form 513NR Instructions 2020 online

This guide provides a clear and accessible step-by-step approach for filling out the Oklahoma Form 513NR Instructions 2020 online. Whether you are a user familiar with tax forms or someone new to this process, this guide aims to assist you in completing the form accurately.

Follow the steps to complete your Oklahoma Form 513NR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

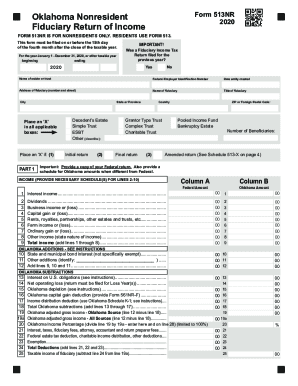

- Fill in the necessary information about the estate or trust at the top of the form, including the name, Federal Employer Identification Number (FEIN), and address.

- Indicate if this is the initial return, final return, or amended return by placing an ‘X’ in the corresponding box.

- Complete the income section by providing the required schedules for interest income, dividends, business income, capital gains, and any other relevant income sources.

- List any Oklahoma additions or subtractions in the designated sections based on the instructions provided.

- Calculate your Oklahoma adjusted gross income and ensure to reflect any percentages as required in the Oklahoma Income Percentage section.

- Enter details related to your deductions including interest, taxes, fiduciary fees, and exemptions.

- Calculate the taxable income and tax due based on the Oklahoma tax table referenced in the instructions.

- If there are credits applicable, provide the necessary information and documentation to claim them.

- Finally, review the completed form for accuracy, save changes, and prepare to submit it. You can download, print, or share the form as needed.

Complete your documents online today!

Oklahoma Income Tax Brackets for 2023 Taxable Income (Single Filers)Taxable Income (Married Filing Jointly)Tax Rate on This Income$1,000 to $2,500$2,000 to $5,0000.75%$2,500 to $3,750$5,000 to $7,5001.75%$3,750 to $4,900$7,500 to $9,8002.75%$4,900 to $7,200$9,800 to $12,2003.75%2 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.