Loading

Get Firpta Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Firpta Certificate online

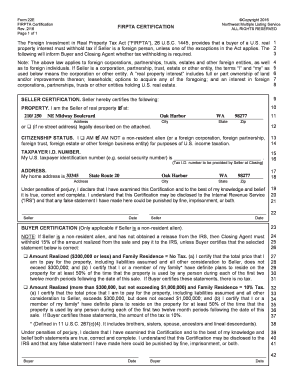

The Firpta Certificate is a crucial document for buyers involved in real estate transactions where a seller is a foreign person. This guide will provide a comprehensive overview and step-by-step instructions on how to fill out this certificate online, ensuring clarity and accuracy in your submission.

Follow the steps to complete the Firpta Certificate online.

- Press the ‘Get Form’ button to access the Firpta Certificate and open it for completion.

- In the 'Seller Certification' section, confirm your status as the seller of the specified property by providing the full address, including the property number, street name, city, state, and postal code.

- Indicate your citizenship status by selecting the appropriate option to confirm that you are not a non-resident alien or a foreign entity for U.S. income taxation purposes.

- Enter your U.S. taxpayer identification number, which could be a Social Security number or another tax ID, in the provided field.

- Complete the home address section with your residential details, including street address, city, state, and zip code.

- Review the declaration statement carefully before signing. Ensure that all information is accurate to the best of your knowledge.

- Sign and date the document in the indicated areas, confirming that you understand the potential penalties for providing false information.

- If applicable, complete the 'Buyer Certification' section. Select the relevant statement based on the sale details and confirm your intentions regarding residence.

- After filling out all required sections, ensure that all information is accurate, and save your progress periodically.

- Once completed, you can download, print, or share the Firpta Certificate as needed.

Complete your Firpta Certificate online today to ensure compliance and a smooth transaction.

The IRS will generally act on these requests within 90 days after receipt of a complete application. All parties must have or at least apply for a US tax ID for a withholding certificate. The applicant must be able to prove their basis in the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.