Loading

Get Municipal Net Profit Tax Net Operating Loss Deduction Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet online

Filling out the Municipal Net Profit Tax Net Operating Loss Deduction Worksheet can ensure that you properly account for your net operating losses. This guide will provide you with clear, step-by-step instructions to help you navigate the form effectively and accurately.

Follow the steps to complete the online worksheet.

- Click ‘Get Form’ button to obtain the worksheet and open it in your document viewer.

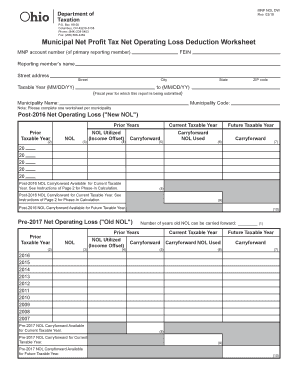

- Start by entering your municipal net profit tax account number, along with the primary reporting member's FEIN, name, and address in the designated fields.

- Specify the taxable year for which you are filing the form, using the format MM/DD/YY for both the start and end dates.

- Enter the municipality name and corresponding municipality code.

- For the Post-2016 Net Operating Loss section, record the NOL incurred for each prior taxable year in the relevant columns, and indicate how much has been utilized.

- Calculate the current taxable year's carryforward by subtracting the utilized amount from the incurred NOL to complete the corresponding fields.

- For the Pre-2017 Net Operating Loss section, enter the number of years the NOL can be carried forward and detail similar information as in the Post-2016 section.

- Utilize the Post-2016 NOL Carryforward Phase-In Calculation to determine the maximum amount available for claiming this year based on your adjusted federal taxable income.

- Finally, review all entries for accuracy. Once completed, you may save changes, download, print, or share the filled-out worksheet as necessary.

Complete your Municipal Net Profit Tax Net Operating Loss Deduction Worksheet online today!

The Act included a provision limiting net operating losses (NOL) incurred after Dec. 31, 2017, to 80% of taxable income rather than the historical 100%. This change was overshadowed by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and eventually was delayed to tax years beginning after Dec. 31, 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.