Loading

Get Form 8278 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8278 Pdf online

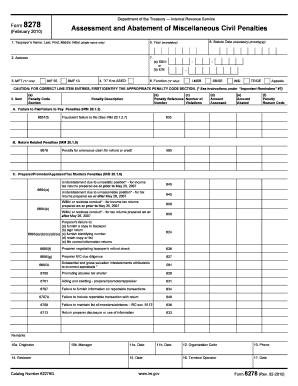

Filling out Form 8278 is an essential step for addressing miscellaneous civil penalties assessed by the IRS. This guide will walk you through the process of completing the form online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to successfully complete Form 8278 online.

- Click the ‘Get Form’ button to access the Form 8278 Pdf and open it in your online editor.

- Begin by entering the taxpayer's name in the designated field, including last name, first name, and middle initial.

- Fill in the address section accurately. Ensure that any new address input will affect all returns filed under the same Taxpayer Identification Number (TIN).

- Select the appropriate Master File Tax (MFT) by marking an 'X' in the box for either IMF 55 or BMF 13.

- Indicate if there is no statute of limitations on the assessment by marking the corresponding box if applicable.

- Provide the year for which the penalty is being assessed, ensuring this is a mandatory field.

- Enter the statute date, ensuring it is in the correct format (mmddyyyy) as this is also a mandatory field.

- Enter either the individual's Social Security Number (SSN) or the entity's Employer Identification Number (EIN) as required.

- Choose the function by marking an 'X' in the appropriate box indicating which department is asserting the penalty.

- Complete the columns for items, including penalty code sections, descriptions, assessed amounts, and reason codes for changes.

- Make sure the Originator and Manager sign the form as both signatures are required for processing.

- Finally, save the changes, download the completed form, or print and share it as needed.

Start filling out your Form 8278 online today to efficiently manage your civil penalty assessments.

Dear Sir or Madam, I am writing to challenge the above Penalty Charge Notice. My car had been stolen on [insert date] and therefore I wasn't driving the vehicle at the alleged time and date of the alleged contravention. Please find enclosed correspondence from the police as proof.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.