Loading

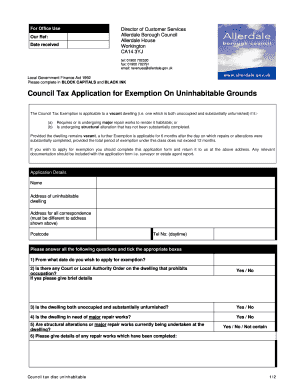

Get Council Tax Application For Exemption On Uninhabitable Grounds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Council Tax Application For Exemption On Uninhabitable Grounds online

Filling out the Council Tax Application for Exemption on Uninhabitable Grounds can seem daunting, but this guide will help you navigate the process with ease. By following these straightforward steps, you can ensure that your application is complete and accurate.

Follow the steps to successfully complete your application.

- Use the ‘Get Form’ button to access the Council Tax Application for Exemption on Uninhabitable Grounds and open it in the designated editing tool.

- Begin the application by entering your name in the provided field. Ensure that all entries are made in block capitals for clarity.

- Input the address of the uninhabitable dwelling in the corresponding section. This should include any relevant details to help identify the property accurately.

- Provide a different address for correspondence. This should not be the same as the address of the uninhabitable property.

- Enter your daytime telephone number, ensuring you can be reached for any further inquiries regarding the application.

- Answer application questions by ticking the appropriate boxes, starting with the date you wish to apply for exemption.

- Indicate whether there is a court or local authority order preventing occupation of the property. If yes, provide brief details.

- Confirm if the dwelling is unoccupied and substantially unfurnished by selecting 'Yes' or 'No'.

- Indicate if major repair works are required at the dwelling, by ticking the appropriate box.

- Indicate if structural alterations or major repairs are currently underway, and provide details of any completed works.

- Describe any required or incomplete repair works, giving as much detail as possible.

- State whether the repair works are visible from outside or through a window.

- Estimate the anticipated completion date for any ongoing alteration or repair work.

- Sign and date the declaration, confirming that all information provided is accurate to the best of your knowledge.

- After completing your form, review all the information to ensure accuracy before saving, downloading, or printing your application for submission.

Complete your Council Tax Application for Exemption on Uninhabitable Grounds online today to ensure your exemption is processed promptly.

The law says that a person is severely mentally impaired if they have a severe impairment of intelligence and social functioning (however caused), which appears to be permanent. This is likely to include people diagnosed with dementia or Alzheimers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.