Loading

Get Pa Sers Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Pa Sers Refund online

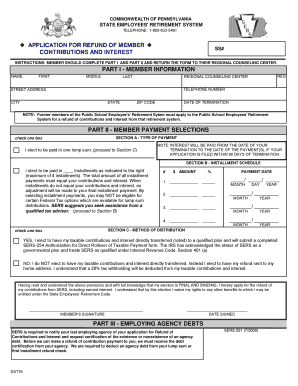

Filing for a refund of member contributions and interest is an important step for individuals who are no longer part of the Pennsylvania State Employees' Retirement System. This guide provides clear, step-by-step instructions to help you complete the Pa Sers Refund form online with ease.

Follow the steps to successfully complete your Pa Sers Refund form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Part I, fill out your member information including your first name, middle name, last name, telephone number, street address, city, state, and ZIP code. Ensure accuracy as this information is essential for processing your refund.

- Provide the date of your termination in the specified field. This date is necessary for the calculation of any interest owed to you.

- In Part II, Section A, select your type of payment by checking one of the boxes. You can choose either a lump sum payment or installment payments.

- If you choose installment payments, complete Section B by indicating the number of installments (up to four) and the specific amount for each installment payment along with the scheduled payment dates.

- In Section C, indicate your method of distribution. If you want your taxable contributions and interest directly transferred to a qualified plan, select 'Yes' and ensure you submit the relevant authorization form. If you prefer to receive your refund at your home address, select 'No' and be aware of the tax withholding.

- After filling out all sections, review your information for accuracy. Ensure all fields are complete and correct.

- Lastly, sign and date the form in the designated areas to authenticate your application. This step is crucial as it indicates your understanding and acceptance of the terms outlined.

- Once you have filled out and reviewed the form, save your changes, download a copy, print it for your records, and prepare to submit it to your regional counseling center.

Begin your process for a refund today by completing the Pa Sers Refund form online.

If you haven't reached SERS normal retirement age, your benefit could be reduced for early retirement. The further you are from SERS normal retirement age, the greater the reduction. SERS normal retirement age is 65, 60, 55, or 50 depending on your class of service, which is listed on your annual member statements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.