Loading

Get Vat 53

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 53 online

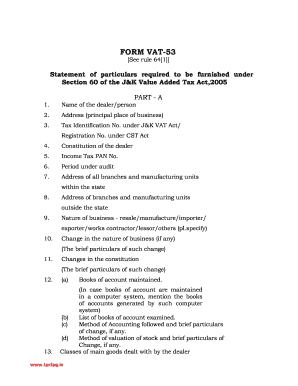

Filing the Vat 53 is an essential requirement under the J&K Value Added Tax Act, 2005. This guide provides a comprehensive, step-by-step approach to help you correctly fill out the form online, ensuring you provide all necessary information.

Follow the steps to effectively complete the Vat 53 form online.

- Press the ‘Get Form’ button to access the Vat 53 document and open it in your preferred editor.

- Begin with Part A of the form. Provide your name, address, and Tax Identification Number under the J&K VAT Act or Registration Number under the CST Act.

- Indicate the constitution of your business, such as sole proprietorship, partnership, or corporation. Also, include your Income Tax PAN number.

- Specify the period under audit and provide the addresses of any branches and manufacturing units, both within and outside the state.

- Describe the nature of your business by selecting from resale, manufacture, importer, exporter, works contractor, lessor, or specify others.

- If there are any changes in the nature of your business or constitution, provide brief particulars of such changes in the designated fields.

- List the books of account that have been examined and the method of accounting followed. Mention any changes and the method of stock valuation as well.

- Move to Part B and detail your gross turnover for sales and purchases, including any adjustments such as returns or excise collected separately.

- Complete the section regarding the determination of output tax on sales and tax on purchases, ensuring accurate calculations are provided.

- In Part C, document any export sales, ensuring that all declaration forms are available on record.

- For interstate sales, confirm if claims are supported with necessary declarations. Provide details as required.

- Repeat the process for Input Tax Adjustments Information in Part E, including balance credit and adjustments details.

- Finally, certify that all information provided is true and correct to the best of your knowledge, and complete the signature section.

- Once all sections are filled out, save your changes, and download or print the form for submission.

Take action now and complete the Vat 53 online for a seamless filing experience.

The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.