Loading

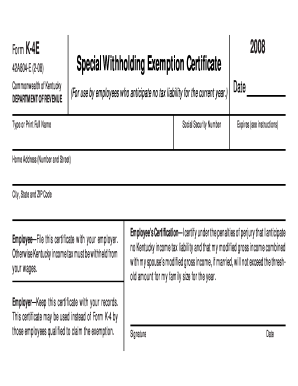

Get Form K4e Commonwealth Of Kentucky Department Of Revenue 2008 Special Withholding Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form K4E Commonwealth Of Kentucky DEPARTMENT OF REVENUE 2008 Special Withholding Exemption online

Filling out the Form K4E is essential for employees who expect to have no Kentucky income tax liability for the current year. This guide will provide you with clear steps to successfully complete the form online, ensuring you follow all necessary instructions.

Follow the steps to fill out the Form K4E online effectively.

- Click 'Get Form' button to obtain the form and open it in your editor.

- Begin by entering your full name in the designated field. Ensure that your name matches the one on your social security card.

- Next, input your social security number accurately without any spaces or dashes.

- Indicate the date you are filling out the form in the specified section.

- In the expiration field, insert the appropriate expiration date as per the form instructions.

- Accurately complete your home address, including the number and street, city, state, and ZIP code.

- Review the statement indicating that, as the employee, you must file this certificate with your employer to prevent withholding of Kentucky income tax from your wages.

- Read the certification statement carefully, ensuring you understand that you certify having no anticipated Kentucky income tax liability.

- Sign the form to certify that the information provided is true and accurate.

- Finally, input the date of your signature and then save, download, print, or share the completed form as needed.

Complete your documents online today to streamline your filing process.

Form K-4 is only required to document that an employee has requested an exemption from withholding OR to document that an employee has requested additional withholding in excess of the amounts calculated using the formula or tables. If neither situation applies, then an employer is not required to maintain Form K-4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.