Loading

Get Wv Cst 280

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV CST 280 online

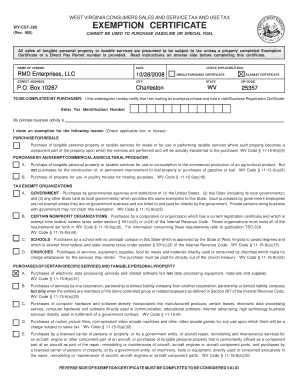

This guide provides clear and supportive instructions for users on how to fill out the West Virginia Consumer Sales and Service Tax and Use Tax Exemption Certificate (WV CST 280) online. Whether you are a business owner or an organization, following these steps will ensure that you complete the form accurately.

Follow the steps to fill out the WV CST 280

- Press the ‘Get Form’ button to access the WV CST 280 form and open it in the editor.

- Enter the name of the vendor in the designated field. This should include the full name of the entity providing the goods or services.

- Choose either the 'Single Purchase Certificate' or the 'Blanket Certificate' by checking the applicable box.

- Indicate your principal business activity in the corresponding field, ensuring it accurately reflects your business operations.

- Complete the additional purchaser information requested, which may include your address and contact details.

- Review all entries for accuracy. Ensure that the completed form is saved in your digital folder.

Start completing your WV CST 280 online to claim your tax exemption effectively.

The West Virginia Claim for Refund or Credit of Consumer Sales Tax Paid to a Vendor/Reseller (CST- 240) is used to claim a refund or credit of sales tax paid to vendors for purchases that are exempt or used in an exempt manner. Claims for Refund or Credit may also be filed online at MyTaxes.WVtax.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.