Loading

Get Form 2201

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2201 online

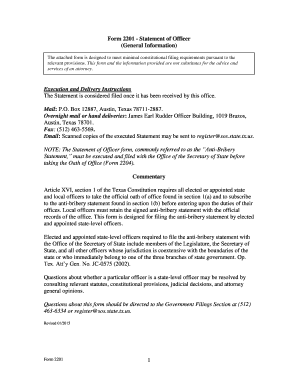

Filling out the Form 2201, also known as the Statement of Officer, is an essential step for elected and appointed state officials in Texas. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the Form 2201 online.

- Click the ‘Get Form’ button to retrieve the form and open it in your preferred online editor.

- Begin by entering your full name in the space provided at the top of the form. This should reflect the name as it appears on your official identification.

- In the section labeled 'Title of Position to Which Elected/Appointed', clearly state the title of the position you are undertaking. Ensure this title is accurate and reflects your official role.

- Proceed to the statement section, where you will swear or affirm that you have not engaged in any acts of bribery related to your election or appointment. Review this statement carefully before proceeding.

- Next, include the date you are completing the form. It is important to use the correct date format.

- Finally, sign the form in the designated area. Your signature indicates that you understand the statement and affirm that all information provided is true under penalties of perjury.

- Once you have completed all sections, you can save your changes. Depending on your needs, you may also choose to download, print, or share the completed form.

Complete your Form 2201 online to ensure you meet the filing requirements for your position.

Related links form

How much you could receive Type of benefitAverage monthly amount for new beneficiaries (October 2022)Maximum monthly payment amount (2023)CPP Disability benefit$1,132.55$1,538.67CPP Post-retirement disability benefit$558.74$558.74CPP children's benefit$281.72$281.72 Dec 28, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.