Loading

Get Mw507m 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw507m 2020 online

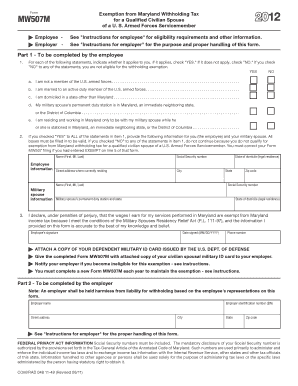

Filling out the Mw507m 2020 form online can be straightforward when you have clear guidance. This form is essential for civilian spouses of U.S. Armed Forces servicemembers to claim an exemption from Maryland income tax withholding.

Follow the steps to complete the Mw507m 2020 form online.

- Click ‘Get Form’ button to access the form and open it in your chosen editor.

- Begin by reviewing the eligibility statements in Part 1. Check 'YES' or 'NO' according to your situation. If you check 'NO' for any statement, you are not eligible for the exemption.

- If you checked 'YES' for all statements in Part 1, proceed to fill out your information. Provide your name, social security number, current street address, and the state of domicile.

- Next, enter your military spouse's information, including their name, social security number, and the military spouse’s permanent duty station.

- After providing the required information, sign and date the form. Ensure all details are accurate to avoid any issues.

- Attach a copy of your dependent military ID card issued by the U.S. Department of Defense to the completed form.

- Submit the completed Form MW507M along with the attached documentation to your employer.

- Remember to renew your Form MW507M each year by completing a new form if you remain eligible. This must be submitted by February 15 to continue the exemption.

Complete your Mw507m 2020 form online today to ensure you benefit from the available tax exemptions.

The employee claims "exempt" as a result of having no tax liability for the preceding tax year, expects to incur no liability this year, and the wages are expected to exceed $200 a week (a new exemption certificate must be re-filed each year by the 15th day of February for employees whose income tax liability is ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.