Loading

Get Tx Form 202 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 202 online

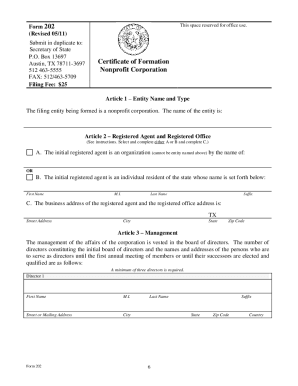

Filling out the TX Form 202 online is a straightforward process that begins with obtaining the form and carefully completing each section. This guide will provide comprehensive, step-by-step instructions to assist users in ensuring their submissions are accurate and complete.

Follow the steps to complete the TX Form 202 online.

- Click ‘Get Form’ button to obtain the form and open it in the provided interface.

- In Article 1, enter the corporate name and type. Ensure it is unique and compliant with naming rules set forth in the Texas Business Organizations Code.

- Proceed to Article 2 where you will select and complete either option A (registered agent as an organization) or option B (registered agent as an individual). Provide the agent's name, address, and ensure that consent has been obtained.

- In Article 3, designate the board of directors. At least three directors must be listed along with their contact information. Avoid prefixes and use only suffixes where applicable.

- Move to Article 4 and indicate if your nonprofit corporation will have members by selecting statement A or B.

- Provide the purpose of the corporation in Article 5. You may use general lawful purpose language but consider including more specific language to align with tax requirements.

- Utilize the Supplemental Provisions/Information section if additional statements or provisions are needed to adhere to tax codes.

- Fill out the Organizer section, including the name and address of the organizer responsible for submitting the form.

- Select the effectiveness of filing option in the corresponding section. Decide if the document becomes effective immediately, on a specified future date, or upon an event occurring.

- Lastly, the organizer must sign the document, confirming the registered agent's consent and affirming the truthfulness of the information provided.

- After completing the form, review all entries for accuracy. Save your changes, download a copy for your records, print, or share the form as necessary.

Start completing your TX Form 202 online now to ensure your nonprofit corporation is properly established.

To establish a nonprofit in Texas, your board should consist of a minimum of three members. These individuals must not be related by blood or marriage. Having a diverse board can enhance decision-making and represent various perspectives. Remember, the TX Form 202 is designed to guide you through this essential setup.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.