Loading

Get Sworn Statement To Close

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the sworn statement to close online

Filling out the sworn statement to close can seem daunting, but it is a straightforward process that can be completed online. This guide provides clear, step-by-step instructions to help you successfully complete this important document with confidence.

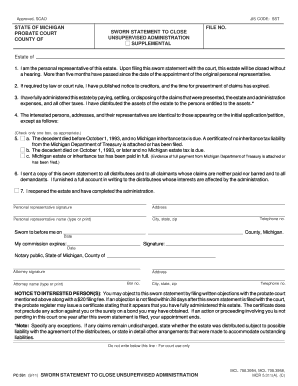

Follow the steps to fill out the sworn statement to close accurately.

- Click ‘Get Form’ button to access the sworn statement to close and open it in your form editor.

- Begin by entering the county where the probate court is located in the designated field. This ensures that the document is filed with the correct jurisdiction.

- Fill in the file number associated with the estate to ensure proper identification of the case.

- In the first section, confirm your role by stating, 'I am the personal representative of this estate.' This designates your authority in the estate process.

- For the second section, verify that you have published notice to creditors if required by law, and confirm that the time for claims to be presented has expired.

- In the third section, assert that you have administered the estate fully by addressing all claims, expenses, and taxes, and distributing the assets appropriately.

- List the names and addresses of the interested persons in section four. Make sure they match those from the original application, noting any changes.

- In section five, select the appropriate box based on the date of the decedent's death and the tax status concerning Michigan inheritance tax. Provide any necessary attachments as required.

- Section six requires you to confirm that you have sent a copy of this sworn statement to all relevant parties involved, ensuring transparency in the process.

- Complete the form with your signature and printed name, along with your address and telephone number. This personal identification is crucial for the court records.

- Include the date and signature of the notary public after the sworn statement is completed; this step validates your declaration before the court.

- Prior to finalizing your document, review all entries for accuracy and completeness. Once confirmed, you can save changes, download, print, or share the form as needed.

Complete your sworn statement to close online today and ensure proper administration of the estate.

An estate in unsupervised administration can be closed by filing a “Sworn Statement to Close Unsupervised Administration” (PC591), or a “Petition for Adjudication of Testacy and Complete Estate Settlement” (PC594), or a “Petition for Complete Estate Settlement, Testacy Previously Adjudicated” (PC593).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.