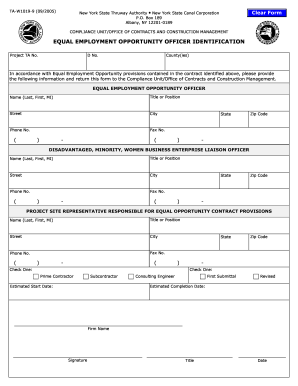

Get Ny Ta-w1019-9 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY TA-W1019-9 online

How to fill out and sign NY TA-W1019-9 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still searching for a prompt and effective option to complete NY TA-W1019-9 at an affordable price?

Our service provides you with a diverse selection of forms that can be submitted online. It only takes a few moments.

Submitting NY TA-W1019-9 no longer has to be perplexing. From now on, handle it comfortably from your home or office directly from your smartphone or computer.

- Locate the form you require in our array of templates.

- Access the document in the online editing tool.

- Review the instructions to determine which information you need to include.

- Select the fillable fields and input the requested information.

- Add the date and affix your electronic signature once you have completed all other fields.

- Examine the document for typos and any other errors. If you need to revise some information, the online editor and its extensive range of tools are available to you.

- Download the updated form to your device by clicking Done.

- Send the digital form to the designated recipient.

How to modify Get NY TA-W1019-9 2005: tailor forms online

Put the appropriate document management features at your disposal.

Perform Get NY TA-W1019-9 2005 with our reliable tool that integrates editing and eSignature capabilities.

If you wish to execute and sign Get NY TA-W1019-9 2005 online effortlessly, then our cloud-based solution is the perfect option. We offer a comprehensive template-based library of pre-formatted documents that you can adapt and complete online. Additionally, there's no need to print the form or use external tools to make it fillable. All essential tools will be immediately accessible upon opening the document in the editor.

Modify and comment on the template

The upper toolbar offers tools that assist you in highlighting and obscuring text, excluding images and graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

Arrange your documents

- Explore our online editing functions and their primary features.

- The editor provides an intuitive interface, so you will quickly learn how to use it.

- We’ll examine three key sections that enable you to:

Yes, a W 9 form can be submitted electronically, depending on the requester’s preferences. Many businesses now accept electronic copies of the W 9 for tax compliance purposes. If you are using a digital service like US Legal Forms, you'll be guided on how to securely send your W 9 to comply with your NY TA-W1019-9 requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.