Get Ny Char014 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR014 online

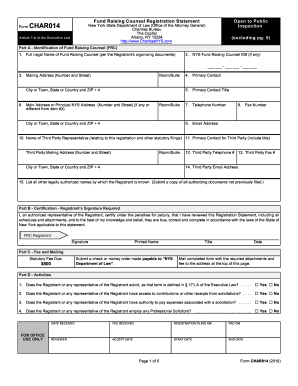

Completing the NY CHAR014, a Fund Raising Counsel Registration Statement, is essential for compliance with New York State laws governing fundraising. This guide provides clear, step-by-step instructions to help users fill out the form effectively, ensuring accurate and complete submissions.

Follow the steps to accurately complete the NY CHAR014 form.

- Press the ‘Get Form’ button to access the NY CHAR014 and open it in your preferred online document editor.

- In Part A, provide the identification information for the Fund Raising Counsel (FRC). Fill in the full legal name as indicated in the registrant’s organizing documents, as well as the NYS Fund Raising Counsel ID number if applicable. Enter the mailing address, including room or suite if necessary, and your primary contact details.

- Continue in Part B to certify the registration statement. An authorized representative of the registrant should sign, providing their printed name, title, and the date of signing to attest that the information is true and complete.

- In Part C, prepare to submit the statutory fee of $800. Make the payment via check or money order payable to the NYS Department of Law and plan to mail the completed form along with any necessary attachments.

- Moving to Part D, answer the questions regarding solicitation activities. Examples include whether the registrant or any representative has access to contributions or has employed professional solicitors.

- In Part E, specify the organization structure, including incorporation details and dates. List all officers, directors, and key employees along with their roles.

- Answer questions in Part F related to associations with other fundraising professionals and charitable organizations. Note any past relationships not covered by previous contracts.

- Complete Part G, which asks about previous conduct, detailing any past license denials or legal issues regarding fundraising activities.

- Proceed to Part H, providing information on any active contracts with charitable organizations, ensuring to include descriptions of the activities involved.

- Finally, fill out Part I with the registrant's private information. This includes federal employer identification numbers and any social security numbers required.

- Review the completed form for accuracy, save your changes, and then download or print the document for mailing along with the payment to the specified address.

Start completing your NY CHAR014 form online today to ensure compliance with New York State fundraising requirements.

Get form

In New York, charities must meet specific financial criteria to require an audit. Generally, if your organization exceeds a certain revenue threshold, an independent audit will be necessary. This serves to enhance transparency and build trust with donors and the public. For guidance on meeting these requirements, refer to resources like NY CHAR014 and platforms such as USLegalForms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.