Loading

Get Security Deed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Security Deed online

Filling out a Security Deed online may seem challenging, but with the right guidance, you can complete the process efficiently. This guide will provide you with step-by-step instructions to ensure that all necessary information is accurately filled out.

Follow the steps to complete your Security Deed online.

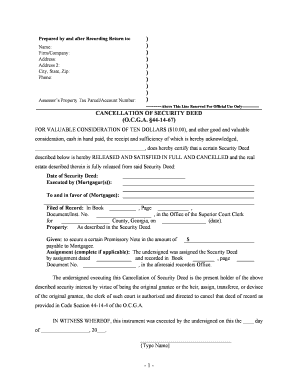

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the person or entity preparing the document in the 'Prepared by' field.

- In the 'Firm/Company' field, input the organization name associated with the preparer, if applicable.

- Fill in the address details including the main address, address line 2 (if any), city, state, and zip code.

- Provide the phone number for contact in the respective field.

- Enter the Assessor’s Property Tax Parcel/Account Number to identify the property related to the deed.

- Complete the section titled 'CANCELLATION OF SECURITY DEED' where you acknowledge the receipt of good and valuable consideration.

- Input the date of the original Security Deed, the names of the mortgagor(s), and the name of the mortgagee.

- Record the details of the filing, including Book, Page, Document/Instrument Number, and the county and date of record in the office of the Superior Court Clerk.

- Describe the property as detailed in the original Security Deed.

- Enter the amount of the Promissory Note that this Security Deed secured.

- If applicable, complete the assignment section by providing details of the assignment of the Security Deed.

- Sign and date the document, ensuring that it is executed properly, including the names and signatures of witnesses and a notary public.

- Finally, review the completed form. Save changes, download for your records, print, or share the form as required.

Complete your Security Deed online today to streamline your document management process.

A deed of trust has a borrower, lender and a “trustee.” The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.