Loading

Get Mn Lg220 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN LG220 online

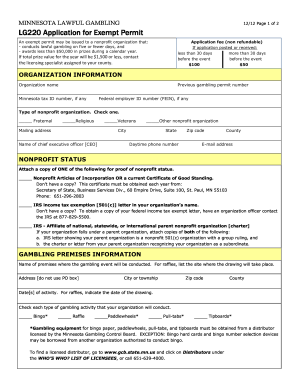

Filling out the MN LG220 application for an exempt permit can seem complex, but this guide will help you navigate the process smoothly. This document is essential for nonprofit organizations seeking to conduct lawful gambling events in Minnesota.

Follow the steps to successfully complete the application.

- Click ‘Get Form’ button to access the application form and open it in your editor.

- Provide your organization information including the organization name, previous gambling permit number, Minnesota tax ID number (if available), federal employer ID number (FEIN, if available), type of nonprofit organization, mailing address, state, city, county, daytime phone number, and email address.

- Attach a copy of one document to prove your nonprofit status. This can be your nonprofit articles of incorporation, IRS income tax exemption letter, or a charter from a parent nonprofit organization.

- Enter the gambling premises information where the event will take place. This includes the name of the premises, street address (no PO boxes), city or township, zip code, and county.

- Indicate the date(s) of the gambling activity. For raffles, specify the drawing date, and check the types of gambling activities your organization will conduct such as bingo, raffles, paddlewheels, pull-tabs, or tipboards.

- Complete the local unit of government acknowledgment by obtaining necessary approvals from city and county officials. This involves capturing signatures and titles from the appropriate personnel.

- The chief executive officer must sign and date the application, confirming that the information provided is accurate and acknowledging that financial reports will be submitted within 30 days of the event.

- Complete and attach a separate application for any gambling conducted over two consecutive days or any gambling conducted on a single day, as applicable.

- Send the completed application along with a copy of your proof of nonprofit status and the non-refundable application fee. Make checks payable to 'State of Minnesota' and mail the documents to the Gambling Control Board.

- After submission, keep an eye out for the financial report form and instructions, which will be sent to you, as you will need to complete and return this within 30 days after the event.

Begin filling out your MN LG220 application online today to ensure your organization can conduct lawful gambling activities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can get physical copies of tax forms at local government offices or public libraries in Minnesota. Alternatively, many people find it more convenient to download and print the forms from the Minnesota Department of Revenue website. MN LG220 also offers easy access to print the forms you will need, at your convenience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.