Loading

Get 1120s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1120S online

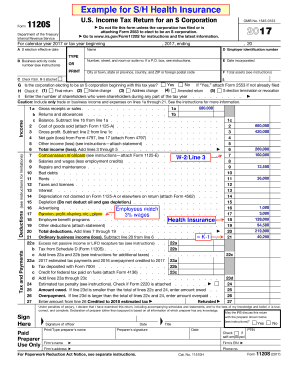

Filing Form 1120S, the U.S. income tax return for an S corporation, can seem complex. This guide provides a clear, step-by-step process to help you complete the form accurately online.

Follow the steps to fill out the 1120S form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the business information at the top of the form. Include the name of the corporation, employer identification number, business activity code, and address details.

- Indicate if the corporation is electing to be an S corporation for the tax year by checking the appropriate box.

- Enter the date of incorporation and the number of shareholders who were part of the corporation during the tax year.

- Provide the total assets of the corporation. This information can typically be found in your accounting records.

- Start detailing your income. Begin with gross receipts or sales, subtract returns and allowances, and then report the cost of goods sold. Follow instructions in the provided sections for calculations.

- Accurately fill out the sections for deductions. Include all relevant business expenses such as salaries, repairs, and taxes. Ensure each category is completed as required.

- Calculate the ordinary business income or loss by subtracting total deductions from total income.

- Complete any additional sections, such as those for taxes owed or any overpayments from the prior year.

- Review all entered information for accuracy. Make any necessary edits or corrections.

- Once all fields are complete, save your changes. You have the option to download, print, or share the form as needed.

Complete your filing process for Form 1120S online today!

There are two different versions of the Schedule K-1: Form 1065, K-1 - This version is for the partners of a partnership. Form 1120S, K-1 - This version is for the shareholders of an S corporation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.