Loading

Get Registrations Form (questionnaire) 13b Ustg - Reverse Charge ... - Ofd Niedersachsen

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Registrations Form (questionnaire) 13b UStG - Reverse Charge ... - Ofd Niedersachsen online

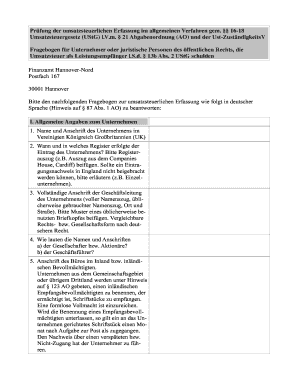

Filling out the Registrations Form (questionnaire) 13b UStG is an essential step for entrepreneurs and legal entities that owe turnover tax in Germany. This guide provides comprehensive, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the registration form seamlessly.

- Click the ‘Get Form’ button to access the form and open it in the editing interface.

- Begin by providing general information about your company, including the company name and complete address as registered in the United Kingdom.

- Indicate the date and the specific register where your company is registered. Attach a copy of the register extract, such as one from Companies House.

- Provide the full address of your company’s management team, including the usual signature and a sample letterhead as documentation.

- List the names and addresses of all partners or shareholders and the company directors in the designated fields.

- Include the address for your domestic office or authorized representative. If applicable, submit a power of attorney for the representative.

- Input your banking details, indicating whether they are domestic or foreign. If naming an alternative bank account, ensure a collection authority is submitted.

- Answer the questions related to the company’s taxation in Germany. Provide details on any taxable performances received from foreigners, including amounts and nature of services.

- Indicate whether your company conducts any other taxable transactions in Germany, explaining them thoroughly if necessary.

- If applicable, explain input taxes incurred, including amounts and periods. This is pertinent for businesses applying for input tax deduction.

- Conclude by ensuring all questions are answered thoroughly, as a detailed response is required for processing your application.

- Once all information is filled out accurately, review the form for completeness. Save your changes, download, print, or share the completed form as necessary.

Complete the Registrations Form (questionnaire) 13b UStG online to ensure timely processing of your turnover tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.