Loading

Get Application For Refund Form.doc - Cmaustralia Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Refund Form.doc - Cmaustralia Org online

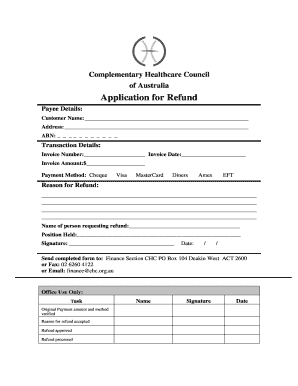

This guide provides step-by-step instructions for successfully filling out the Application For Refund Form from Cmaustralia Org. Whether you are familiar with refund processes or new to them, this comprehensive resource will assist you in completing the form with ease.

Follow the steps to complete your refund application seamlessly.

- Click the ‘Get Form’ button to download and open the form in the editing interface.

- In the 'Payee Details' section, fill in your full name in the 'Customer Name' field. Provide your complete address in the corresponding area, and if applicable, include your Australian Business Number (ABN).

- Under 'Transaction Details', locate the 'Invoice Number' field and enter the invoice number associated with your transaction. Next, fill in the 'Invoice Date' followed by the 'Invoice Amount', ensuring you specify the amount in dollars.

- Select your payment method by marking the appropriate box next to the method you used — options include Cheque, Visa, MasterCard, Diners, Amex, or EFT.

- In the 'Reason for Refund' section, provide a detailed explanation for the refund request. Make sure your reasoning is clear and concise, as this information is crucial for processing your application.

- Fill in your name in the 'Name of person requesting refund' field and indicate your 'Position Held' within the organization, if applicable.

- Sign and date the form at the designated area. Ensure your signature is placed correctly before submitting.

- After completing the form, review all fields to ensure accuracy. You can save your changes, download, print, or share the completed form as required.

Complete your refund application online today to expedite the process.

Government Code section 16302.1 permits state agencies/departments to remit overpayments of $10.00 or less to the Treasury as other taxes, penalties, interest, license, or other fees, or any other amount due to the state, subject to the right of the payer to make a claim for refund if otherwise authorized by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.