Loading

Get Ira Sep Distribution Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA SEP Distribution Request Form online

Completing the IRA SEP Distribution Request Form online can be a straightforward process when you know the steps to follow. This guide provides clear and detailed instructions to help you successfully navigate each section of the form.

Follow the steps to efficiently complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

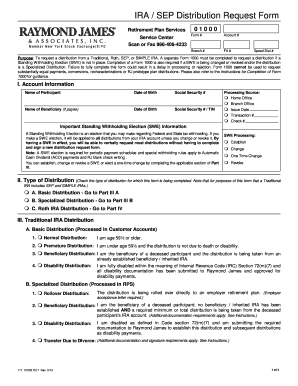

- Provide your account information in Section I, including the name of the participant, date of birth, and Social Security number. If applicable, include the beneficiary's information.

- In Section II, check the appropriate type of distribution: Basic Distribution, Specialized Distribution, or Roth IRA Distribution.

- Fill out Section III, selecting the specific type of Traditional IRA distribution you are requesting, such as Normal, Premature, or Disability Distribution, and provide necessary details.

- Complete Section IV if you are requesting a Roth IRA Distribution, indicating whether it is a Qualified or Non-Qualified distribution.

- In Section V, specify the distribution amount, the form of distribution (complete or partial), and how you would like the payment to be processed.

- Proceed to Section VI to make your Standing Withholding Election choice regarding Federal and State tax withholding.

- Fill in Section VII to indicate your Federal and State income tax withholding elections based on your selections.

- Finally, read the acknowledgments in Section VIII, then print your name, sign the form, and date it. You may also indicate your role in the transaction.

- Once all sections are completed, you can save changes, download, print, or share the form as needed.

Complete the necessary documents online today for a seamless process.

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.