Loading

Get F83345 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F83345 2 online

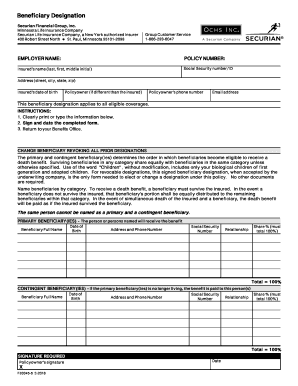

Filling out the F83345 2 form is an essential step in designating beneficiaries for certain policies. This guide provides clear instructions to help you complete the form online with confidence and accuracy.

Follow the steps to successfully fill out the F83345 2 online

- Click ‘Get Form’ button to access the F83345 2 form and open it in your preferred editor.

- Enter the employer name and policy number in the designated fields.

- Provide the insured's name by entering their last name, first name, and middle initial as required.

- Input the insured's social security number or ID to correctly identify the insured individual.

- Fill in the address details for the insured, including the street address, city, state, and zip code.

- Indicate the insured's date of birth to confirm their eligibility.

- If applicable, provide the name of the policyowner, especially if it differs from the insured.

- Enter the policyowner's phone number and email address for further communication.

- Designate primary and contingent beneficiaries by filling out their names, dates of birth, addresses, phone numbers, social security numbers, relationships, and the percentage share for each. Ensure that each share totals 100%.

- Review all the entered information for accuracy and clarity.

- Sign and date the completed form where indicated to authenticate your submission.

- Save any changes, and proceed to either download, print, or share the completed form as needed.

Complete your F83345 2 form online today to ensure your beneficiary designations are accurately recorded.

In the event your primary beneficiary dies before or at the same time as you, most policies also allow you to name at least one backup beneficiary, called a “secondary” or “contingent” beneficiary. If the primary beneficiaries are all deceased, the secondary beneficiaries receive the death benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.