Loading

Get Tx Fin603 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX FIN603 online

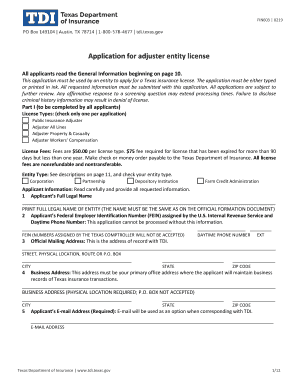

The TX FIN603 form serves as the application for an adjuster entity license in Texas. This guide will help you navigate the form effectively and provide step-by-step instructions to ensure you complete the application successfully.

Follow the steps to fill out the TX FIN603 online accurately.

- Click ‘Get Form’ button to access the TX FIN603 application and open it for editing.

- Begin by completing Part I, which includes selecting the license type you are applying for (only one can be checked per application) and noting the applicable license fees. Ensure you specify your entity type by selecting the appropriate option.

- Fill in the applicant information section with the legal name of your entity, Federal Employer Identification Number (FEIN), and daytime phone number. This information is mandatory for processing.

- Provide the official mailing address where records will be kept. This should be the address registered with the Texas Department of Insurance.

- Complete the business address section with the primary office location. Do not use a P.O. Box in this section and ensure it is a verifiable physical address.

- List your email address, as it will be utilized for communications regarding your application.

- Answer the resident status questions carefully. Indicate whether your entity currently holds a similar license in your state of residence and provide additional information if applicable.

- Move to Part II and detail all responsible individuals associated with the entity, including their titles, addresses, social security numbers, and any applicable fingerprints or licenses.

- For each responsible individual and entity, ensure you include accurate information detailing controlling relationships and attach supporting documents as necessary.

- Complete Part III by providing necessary documentation that demonstrates your business is organized to conduct insurance operations.

- Proceed to answer all screening questions in Part IV, providing full disclosure, especially if any affirmative responses are given.

- If you are applying as a Public Insurance Adjuster, complete Part V detailing criminal history records and attaching necessary documentation.

- Complete Part VI if applicable, ensuring that a designated qualifying individual holds the correct licensure.

- In Part VII, certify that your application is complete, truthful, and that you are aware of the legal requirements for licensing.

- After reviewing all sections for accuracy, save your changes. You may then download the completed form for printing or sharing as required.

Start filling out the TX FIN603 form online today to ensure your application for an adjuster entity license is submitted correctly.

(a) A creditor may contract for, charge, and receive from an obligor interest or time price differential. (b) The maximum rate or amount of interest is 10 percent a year except as otherwise provided by law. A greater rate of interest than 10 percent a year is usurious unless otherwise provided by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.