Loading

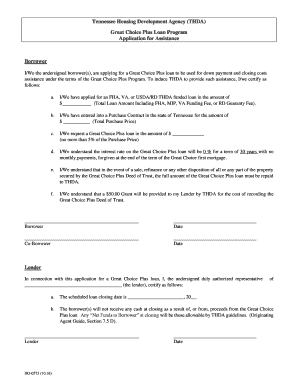

Get I/we The Undersigned Borrower(s), Are Applying For A Great Choice Plus Loan To Be Used For Down

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the I/We The Undersigned Borrower(s), Are Applying For A Great Choice Plus Loan To Be Used For Down online

This guide aims to support users in completing the I/We The Undersigned Borrower(s), Are Applying For A Great Choice Plus Loan To Be Used For Down application form online. By following the steps outlined below, users will efficiently navigate through the form and ensure accurate completion.

Follow the steps to fill out your application for the Great Choice Plus loan online.

- Click ‘Get Form’ button to access the application form and open it in your preferred editor.

- Begin by filling in the total loan amount you have applied for, which should include all applicable fees such as FHA, MIP, VA funding fee, or RD guaranty fee in the designated field.

- Next, enter the total purchase price of the property for which you have entered into a purchase contract in the appropriate section.

- Specify the amount you are requesting for the Great Choice Plus loan, making sure it does not exceed 5% of the purchase price.

- Acknowledge that the interest rate on the Great Choice Plus loan is set at 0% for a term of 30 years, with no monthly payments and that it will be forgiven at the end of the term of the Great Choice first mortgage.

- Understand and confirm that in the event of a sale, refinance, or any other disposition of the property secured by the Great Choice Plus deed of trust, the total amount of the Great Choice Plus loan must be repaid to THDA.

- Recognize that a $50.00 grant will be provided to your lender by THDA for the cost of recording the Great Choice Plus deed of trust.

- Finally, ensure to sign and date the form in the designated Borrower and Co-Borrower sections, and if applicable, the Lender signature and date before submission.

- Once all details are filled in, you can save changes, download, print, or share the completed form as needed.

Complete your Great Choice Plus loan application online now!

A larger down payment also helps you build equity faster and protects you and the lender against depreciation and potential loss. All cars famously depreciate the moment they're driven off the lot.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.