Loading

Get Az 400g 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ 400G online

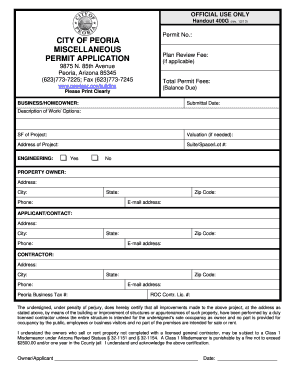

This guide provides comprehensive instructions on filling out the AZ 400G miscellaneous permit application online. By following these steps, you will ensure your application is completed accurately and efficiently.

Follow the steps to successfully complete the AZ 400G form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the Submittal Date to indicate when you are submitting the form.

- In the Description of Work/Options section, provide a clear description of the project you intend to undertake.

- Indicate the square footage of the project in the SF of Project field.

- If applicable, enter the Valuation amount related to your project.

- Additionally, include the Suite/Space/Lot # if relevant.

- For the Property Owner section, input their Address, City, State, Phone, Zip Code, and E-mail address.

- In the Applicant/Contact section, ensure to fill in similar details as required for the Property Owner.

- Complete the Contractor section with their Address, City, State, Phone, Peoria Business Tax #, Zip Code, E-mail address, and ROC Contract License #.

- Finally, to certify the information provided, sign where indicated as Owner/Applicant, and date your submission.

- Once all information is filled, you can save changes, download, print, or share the form as necessary.

Start completing your AZ 400G form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The time it takes to learn AZ-400 varies based on your prior experience and commitment. On average, candidates spend between four to six weeks preparing for the exam. Dedicating a few hours each week to study, along with hands-on practice using Azure, can enhance your understanding. Effective study plans and resources can significantly reduce your learning time.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.